As someone who is OBSESSED with automation, I’m always trying to find new ways to automate different parts of my business. There are so many benefits to automation and you’ve probably got some marketing or workflow automation, but there are so many other areas in your business (such as finance) that you can automate that you didn’t even think about!

Finances is probably the one thing in my business I don’t enjoy dealing with and I know it’s the same for a lot of business owners out there. I think it’s especially hard when you work for yourself as it’s just another ‘hat’ you have to wear. It can get frustrating and exhausting having to stay on top of everything all the time. Going into a new financial year is a great time for reflection and I feel like this year I have finally gotten to a place where I have a healthy relationship with my business finances. That’s mostly because I have automated what I can and it’s not taking too much of my mental load.

SO.. because I know it’s not really something us biz owners talk about very much, I thought I would give you an insight into how I automate the financial side of my business and what tools I use to make it happen.

Before we go any further, I just want to mention that just because this is what I do for my personal circumstances might not necessarily work for your business type/structure. So I would recommend talking to your bookkeeper or accountant before making any changes to the financial side of your business.

First up: Dubsado for invoicing

I couldn’t get through even one blog without mentioning Dubsado but it’s where I send all of my invoices to my clients for one-off and ongoing projects. Dubsado has some awesome invoicing and payment plan features which I make the most out of.

Automation #1: Automate invoices based off proposals

When using packages on proposals in Dubsado, you can automatically create an invoice based on acceptance of that proposal depending on what the client selects (or if you have a set package price). This means that as soon as they accept the proposal, the invoice is automatically issued to them and they can make payment straight away. No need for you to manually check the proposal and create the invoice yourself.

Why I love this: The client is issued their invoice immediately on acceptance of the proposal and I don’t have to do any manual tasks for this to happen.

Automation #2: Payment plan based on project dates

In addition to the invoice being created automatically, you can also create payment plans in Dubsado that will automatically update depending on the milestones you select. For me that looks like 30% on signing, 30% at the start of the project and 40% at the end of the project (see my example below).

Why I love this: The client knows exactly what they need to pay and when and Dubsado workflows can be triggered based on the payment milestones as well. I also don’t need to do anything manually (other than set the project dates before sending the proposal) for this to happen.

Automation #3: Automate Payments using Square

Dubsado offers 3 different online payment processors that natively integrate with Dubsado invoices, Stripe, Square & Paypal. I use Square for all of my payments and I wouldn’t have it any other way. I know that the fees can put people off using an online processor but with it being a tax deductible business expense, I’m happy to pay for the convenience. I also receive my money the next business day, so I never have to wait long.

Why I love this: Payments are automatically reconciled on my Dubsado invoices and any workflows attached to the payment plan can continue quicker as I don’t have to wait for the bank deposit and then manually apply the payment to the Dubsado invoice. I also never have to give out my bank details so it’s easy if your details change, you don’t have to let your clients know.

Next up: HNRY

So now that we have the client facing parts out of the way, what happens next? Enter: Hnry. HNRY is an online accounting service for freelancers and contractors in Australia that makes managing taxes a breeze. They handle everything – income tax, GST, super contributions – so you don’t have to stress about it. Plus, they’ve got invoicing and expense tools built in (including your own debit card to make purchases on). Basically, they take care of all the tax stuff right when you get paid, so you’re always on top of things. They charge a 1% fee on every payment deposited into your HNRY account, but it’s all tax deductible (which they claim automatically). This fee also includes a quarterly BAS and an EOFY tax return – totally worth it in my opinion!

Automation #4: Automate tax payments through HNRY

So when I get paid through Square, my connected bank account for payouts is my HNRY account and as soon as a payment comes through, HNRY automatically takes out the GST and Income tax obligations from that payment.

Why I love it: When I get a deposit in my personal bank account, I know that money is MINE to spend and I don’t have to worry about manually putting away money for my tax obligations.

Automation #6: Automate investing through Sharesies

As well as automatically allocating your GST and tax obligations, HNRY can also distribute your income to other institutions such as super and investing accounts.

So what is Sharesies? Sharesies is a super easy-to-use investment platform in Australia that’s perfect for anyone, whether you’re just starting out or already know about investing. You can dip your toes into investing with just a small amount of money and choose from a bunch of shares and funds. They’ve got great educational resources and a really simple interface, so you can make smart choices without getting overwhelmed. It’s all about making investing easy and affordable, so you can build and manage your portfolio at your own pace.

Why I love it: I nominate 10% of my income to be distributed to Sharesies everytime I get paid through HNRY (and have automatic investing set up in my sharesies account) which takes the stress out of investing.

Automation #7: Automate expenses account top up

As well as being able to automatically distribute funds for investment, you can also allocate a percentage of your funds to go directly onto your HNRY debit card account. This feature ensures that I always have enough money set aside for all my business expenses without needing to manually transfer money to another account. It’s super convenient because it means I don’t have to worry about whether I’ll have enough money to cover upcoming costs – everything is taken care of automatically.

Why I love it: I don’t have to stress about keeping track of funds for expenses. It’s a huge relief knowing that my business expenses are always covered without any extra effort on my part. This automation not only saves me time but also gives me peace of mind, allowing me to focus more on my work and less on managing finances.

Automation #8: Automate expenses raised through HNRY

As well as being able to automate my expense fund top ups, when I use my HNRY debit card for my business expenses, it will automatically raise an expense in HNRY (which I just add a pic of my receipt to) and

Why I love it: I only need to spend about 5 minutes a week attaching my receipts to my expenses and the HNRY team take care of the rest. All of my expenses are added towards my BAS and Tax return.

Rounding it out with: Zapier

I couldn’t talk about automation without bringing up Zapier. If you didn’t know, Zapier is this amazing tool that helps you automate pretty much any task between different apps you use. It connects over 1000+ different apps, so you can set it up to automatically do things like save email attachments to Google drive, add new customers to your CRM, or post social media updates when you publish a new blog. It’s like having an extra pair of hands that take care of all those little repetitive tasks, saving you a ton of time and reducing errors. Honestly, it’s a game-changer for productivity and I could talk about it all day (save that for another blog) but I have a zap for pretty much EVERYTHING, including some to help me with my accounting.

Automation #9: Zap: Automate saving invoices that arrive in gmail to google drive

Most of the time I get my receipts and invoices via email. Other than labelling them and then all the attachments getting buried in folders in my inbox, I wanted an easy way to extract the information and save the attachments in google drive folder. And guess what – there is a zap for that! (swipe the template here)

This is what it looks like:

In addition to using filters in gmail to automatically label certain things, Zapier picks up when I label an email ‘Expenses’ and then searches for the attachment and then saves it in the current financial year folder.

Why I love it: All of my invoices and receipts are saved and filed correctly making tax time a breeze without having to lift a finger.

Automation #10: Zap: Automate converting receipts to PDF if they don’t have an attachment and THEN save them to google drive

What happens if I label an email as an expense in Gmail but it doesn’t have a PDF attached? Although I was very happy with my previous zap, I was finding some expenses had the receipt in the body of the email rather than as an attachment. That meant my zap would error out and I would have to manually screenshot and save it which was so frustrating! So I ended up finding a free tool where you can forward your emails and then it will convert it to pdf and send it back to you – so handy. So I made another zap that forwards to https://pdfconvert.me/ if no attachment is found in the email and then automatically labels it as an expense when it is emailed back to me (then the previous zap is triggered) – problem solved!

Here’s what it looks like and you can swipe my template here

Why I love it: No more missing receipts in my emails and being able to convert them to PDF automatically – win!

Bonus #1: ‘In flow to grow’ by Kate Addamo

It’s technically *not* an automation in itself, but for managing your cashflow and forward planning in your business I love using the amazing ‘In Flow to Grow’ spreadsheet by Kate Addamo. It’s great for getting clarity on what is coming in and out of your business, understanding your expenses and when your upcoming payments are due. I use this to forward plan my year so I know when I need to increase my capacity to cover upcoming bills and expenses.

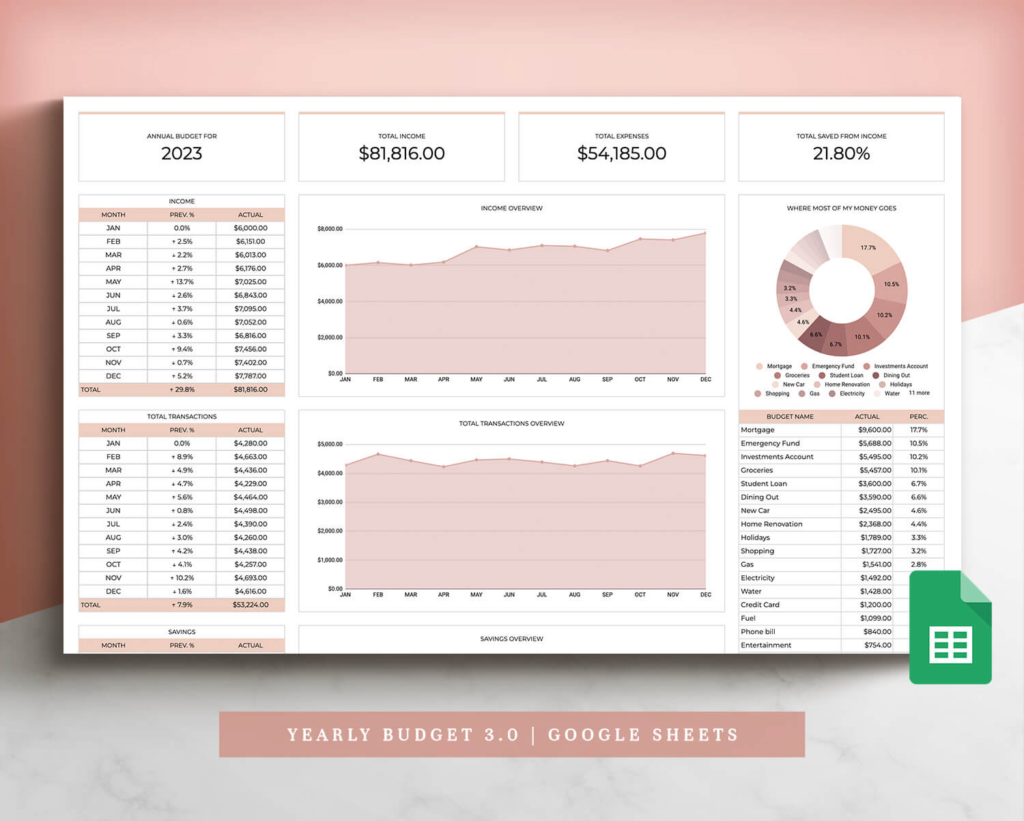

Bonus #2: Yearly Budget 3.0 by Coplenty

Again it’s technically *not* an automation but another spreadsheet that I use for my personal and family finances. I pretty much take all the data of my business finances and combine them with my husbands salary and we plan out our entire year financially through this spreadsheet. It helps us have a good overall view of our finances and where we are at and keeps us super accountable to each other.

TLDR: I use Dubsado invoicing & payment plans, HNRY & Zapier to automate my financial admin in my business.

I know it may seem like a lot of steps (and I know I pay for the convenience of all these tools) but at the end of the day I spend about 1 hour per month (max) working on my business finances and I am happy with that. It’s my least favourite thing about running a business but I know it’s important which is why I put these systems in place. I hope this helps you to think about how you can automate your financial admin and If you need some ideas or help I’m here, just give me a shout.

p.s If you sign up to any of the programs I mentioned using the affiliate links I’ve shared means I get a little something for doing so BUT I would never share anything I didn’t stand by. You can also raid my digital toolbox here.

Packed with links and resources as well as detailed step-by-step instructions, you can begin creating a more professional customer experience in no time.

Pop your email below, and I’ll personally deliver it straight to your inbox!